Auto Insurance in and around Battle Creek

Take this great auto insurance for a spin, Battle Creek

Insurance that lets you take the front seat

Would you like to create a personalized auto quote?

State Farm Has Coverages For Your Needs

Whether it's an electric vehicle or a hybrid, your vehicle could need high-quality coverage for the important work it contributes to keep you moving. And especially when the unanticipated happens, it can be important to have the right insurance for this significant factor of your daily living.

Take this great auto insurance for a spin, Battle Creek

Insurance that lets you take the front seat

Your Hunt For Auto Insurance Is Over

The right options may look different for everyone, but the provider can be the same. From uninsured motor vehicle coverage and liability coverage to savings like accident-free driving record savings and an older vehicle passive restraint safety feature discount, State Farm really shifts these options into gear.

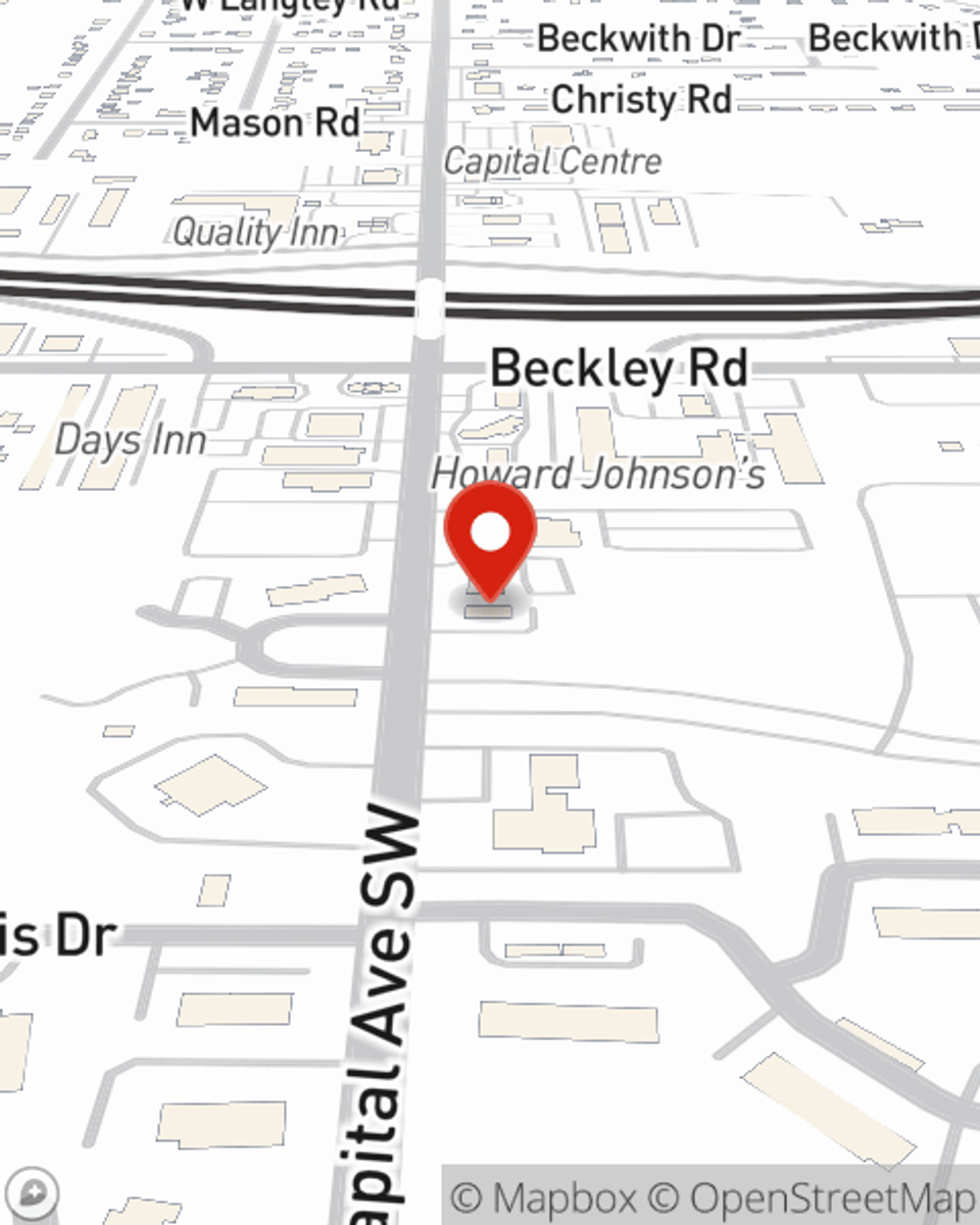

State Farm agent Paul Clark is here to help describe all of the options in further detail and work with you to create a policy that fits your needs. Call or email Paul Clark's office today to explore your options.

Have More Questions About Auto Insurance?

Call Paul at (269) 979-4000 or visit our FAQ page.

Simple Insights®

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

When do you need an international driver's license?

When do you need an international driver's license?

Learn how to legally drive with an international driver's license while in a foreign country.

Simple Insights®

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

When do you need an international driver's license?

When do you need an international driver's license?

Learn how to legally drive with an international driver's license while in a foreign country.