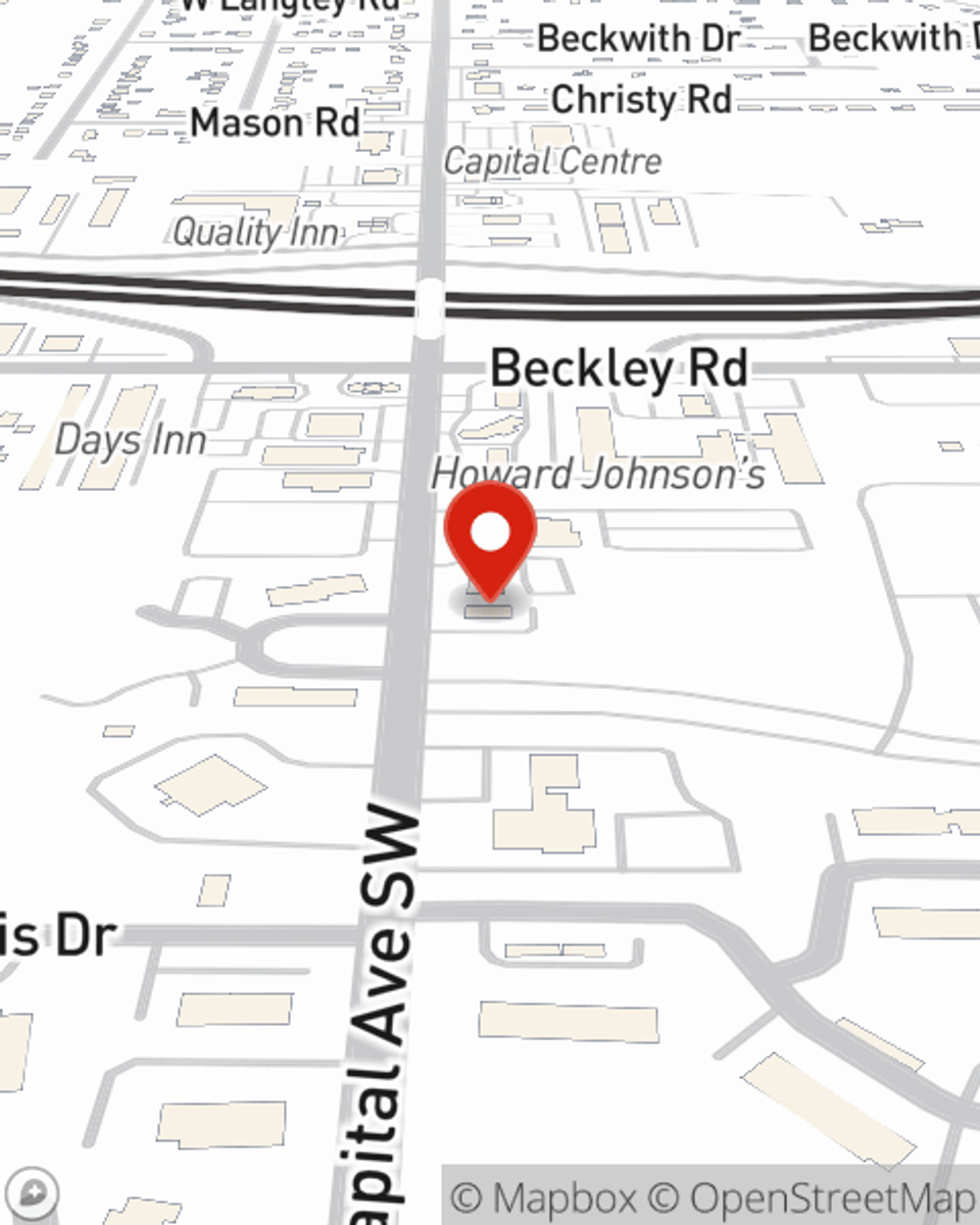

Business Insurance in and around Battle Creek

Get your Battle Creek business covered, right here!

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

Running a business is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, business continuity plans and worker's compensation for your employees.

Get your Battle Creek business covered, right here!

Cover all the bases for your small business

Cover Your Business Assets

Whether you own a pet groomer, a bakery or a beauty salon, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call or email agent Paul Clark to learn more about your small business coverage options today.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Paul Clark

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.